The Self-Funded Advantage: Building Success on Your Terms

Both my businesses were self-funded. No investors. No safety nets. Just strategy, discipline. And doggedly relentless execution.

Most founders chase funding. They think more capital = faster growth. They think more investors = less risk. They think bootstrapping is a struggle, not a strategy.

But here’s what they don’t realize—

↳ Mailchimp hit $700M ARR. No funding.

↳ Basecamp rejected VC. Stayed profitable.

↳ Spanx began with $5K. Now a billion-dollar brand.

↳ Patagonia chose impact over hypergrowth. Won truly big.

The secret? → Control beats capital.

And Small Giants by Bo Burlingham lays it all out. It’s not a book. It’s a manifesto for founders who refuse to trade autonomy for speed.

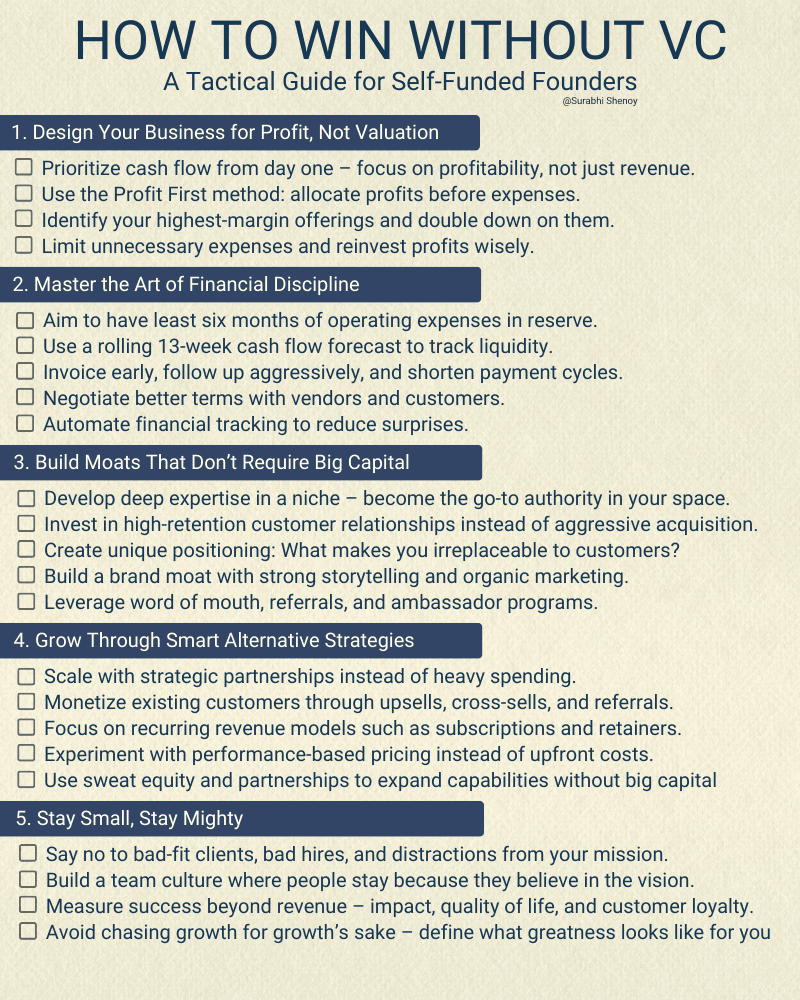

The Tactical Guide for Self-Funded Success

1. Design Your Business for Profit, Not Valuation

Building a self-funded business requires a fundamental shift in mindset. While VC-backed startups often prioritize growth metrics and valuation, bootstrapped businesses thrive on profitability.

- Prioritize cash flow from day one – focus on profitability, not just revenue

- Use the Profit First method: allocate profits before expenses

- Identify your highest-margin offerings and double down on them

- Limit unnecessary expenses and reinvest profits wisely

When you’re not chasing the next funding round, you can build a business that generates real value – both for your customers and your bank account.

2. Master the Art of Financial Discipline

Without the cushion of venture capital, financial discipline becomes your superpower. Every dollar matters, and tight cash management creates resilience.

- Aim to have at least six months of operating expenses in reserve

- Use a rolling 13-week cash flow forecast to track liquidity

- Invoice early, follow up aggressively, and shorten payment cycles

- Negotiate better terms with vendors and customers

- Automate financial tracking to reduce surprises

This financial discipline isn’t just about survival – it creates the foundation for sustainable growth without external funding.

3. Build Moats That Don't Require Big Capital

VC-backed companies often compete by outspending competitors. Self-funded businesses win through strategic advantages that don’t require massive capital.

- Develop deep expertise in a niche – become the go-to authority in your space

- Invest in high-retention customer relationships instead of aggressive acquisition

- Create unique positioning: What makes you irreplaceable to customers?

- Build a brand moat with strong storytelling and organic marketing

- Leverage word of mouth, referrals, and ambassador programs

These competitive advantages compound over time, creating defensibility without burning through cash.

4. Grow Through Smart Alternative Strategies

Self-funded businesses need creative approaches to scale without massive capital infusions.

- Scale with strategic partnerships instead of heavy spending

- Monetize existing customers through upsells, cross-sells, and referrals

- Focus on recurring revenue models such as subscriptions and retainers

- Experiment with performance-based pricing instead of upfront costs

- Use sweat equity and partnerships to expand capabilities without big capital

These strategies allow you to grow sustainably while maintaining your independence and financial health.

5. Stay Small, Stay Mighty

The most successful bootstrapped businesses embrace their size as an advantage, not a limitation.

- Say no to bad-fit clients, bad hires, and distractions from your mission

- Build a team culture where people stay because they believe in the vision

- Measure success beyond revenue – impact, quality of life, and customer loyalty

- Avoid chasing growth for growth’s sake – define what greatness looks like for you

This focused approach allows self-funded businesses to remain agile, profitable, and true to their original mission.

The Self-Funding Reality Check

Let’s be real: bootstrapping isn’t easy. You don’t just work harder. You evolve.

Because the biggest reason founders fail at scaling? They never become CEOs. They stay stuck in execution. They micromanage everything. They become the bottleneck.

Building a self-funded business isn’t just about avoiding investors – it’s about creating a fundamentally different kind of company. One built on profitability, sustainability, and owner independence.

Who Should Read "Small Giants"

Small Giants is perfect for:

- Founders who value independence over rapid growth

- Business owners questioning the “bigger is better” mindset

- Entrepreneurs looking for alternative growth models

- Leaders who want to build companies with purpose beyond profit

The book showcases companies that chose to be great instead of big, providing a blueprint for creating businesses that prioritize excellence, culture, and purpose.

And if you’d like to explore more strategic frameworks from My Bookshelf, you might find these interesting:

- Profit First – The ideal financial foundation for self-funded companies pursuing sustainable, meaningful growth

- The E-Myth Revisited – Transform your founder-dependent business into a self-running system that delivers Small Giants-style impact

BONUS: Read To Lead: 30 Books Every Founder Must Read.

BONUS: Read To Lead: 30 Books Every Founder Must Read.