Last week, a tech consulting founder said to me:

“We’ve been getting ₹20–30L projects consistently. I want to grow. I want bigger projects.”

I asked him, “If you land bigger projects… grow from ₹3Cr to ₹30Cr a year, what will change?”

– Will you get more time?

– Will you take more money home?

– Will your business become easier to run?

That’s when he paused.

Like many founders, he wanted growth —but he had never defined what that growth is meant to create. They never ask —what it’s really for?

Revenue isn’t wealth.

Profit creates income—but most of it gets reinvested to keep the business growing.

It helps you live well, but rarely multiplies over time.

Real wealth is created when you build a business that others want to buy, fund, or run without you.

That’s valuation. That’s enterprise value.

And most founders never get there—not because they’re not capable, but because they’ve never been shown what comes after revenue.

In my work with founders—whether we’re growing revenue, improving profitability, or preparing for an exit—this is the shift I guide them through.

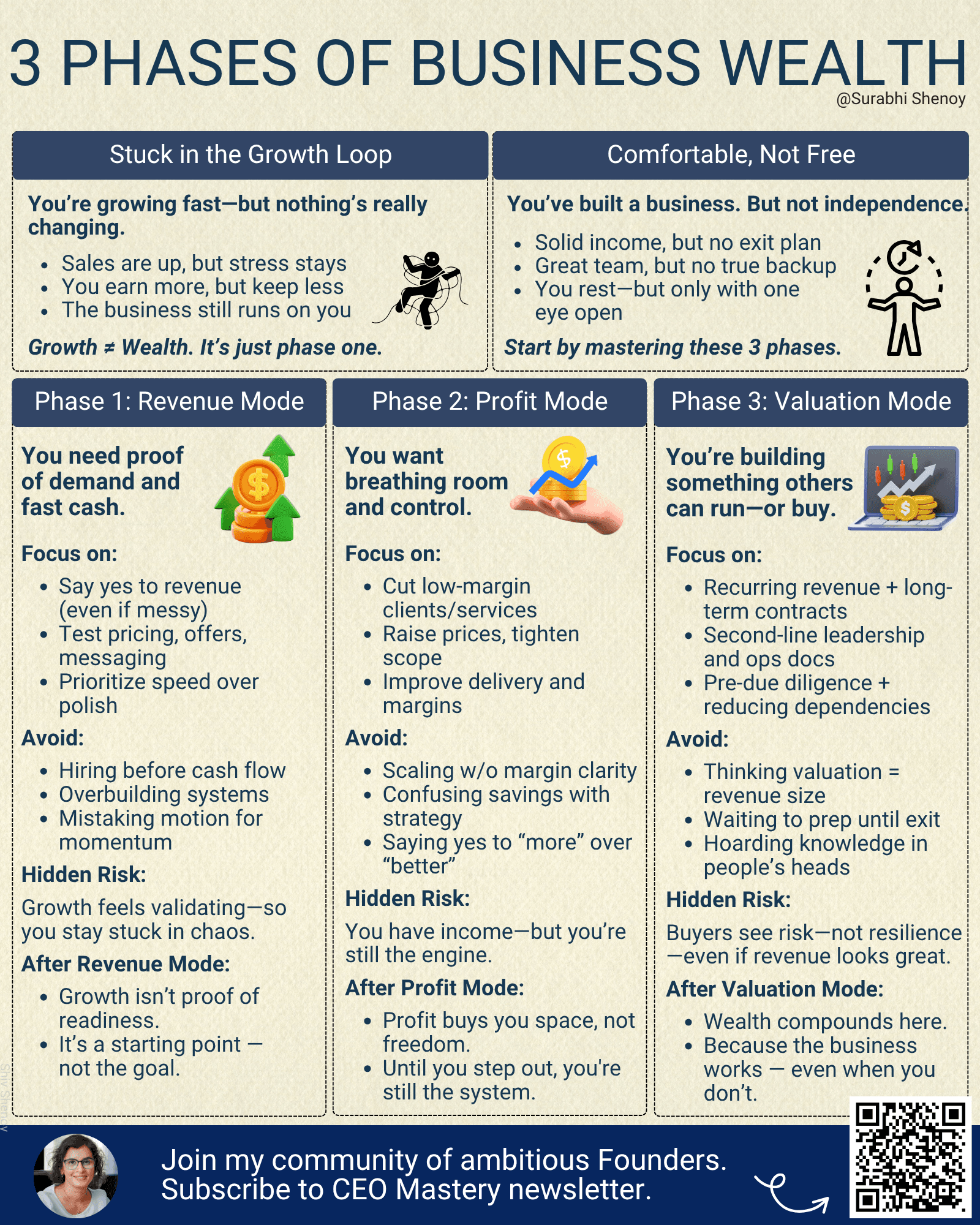

The 3 Phases of Business Wealth

There’s a clear sequence every founder moves through.

Each phase serves a purpose. But staying in one too long comes at a cost.

Phase 1: Revenue Mode

Goal: Get sales. Prove demand. Get cash flowing.

What to Focus On:

- Say yes to revenue-generating work (even if messy)

- Test offers, pricing, messaging

- Prioritize speed over polish

What to Avoid:

- Hiring too early

- Overbuilding systems

- Confusing motion for momentum

Hidden Risk:

Founders get stuck here because growth feels like success—even if it’s not sustainable.

Phase 2: Profit Mode

Goal: Keep more of what you earn. Create financial breathing room.

What to Focus On:

- Cut poor-fit clients and low-margin services

- Raise prices or reduce scope

- Systematize delivery and team operations

- Improve cash flow and contribution margins

What to Avoid:

- Scaling top-line without margin clarity

- Chasing “more” instead of “better”

- Thinking savings = strategy

Hidden Risk:

You build a solid income machine—but it still depends on you. You’re still the engine.

Phase 3: Valuation Mode

Goal: Build a company that creates compounding wealth—even without you.

What to Focus On:

- Recurring revenue and long-term contracts

- Strong second line of leadership

- Operational documentation and reporting

- Reducing dependency on founder, clients, and individuals

- Run internal mock due diligence annually.

What to Avoid:

- Thinking valuation is just about revenue size

- Waiting until you want to exit to start prepping

- Keeping knowledge in people’s heads instead of systems

Hidden Risk:

You think you’ve built something valuable—but buyers see risk, not resilience.

Revenue and Profit Make You Comfortable.

Valuation Creates Options. Option to sell, hand over to your kids, or get a professional team and step back.

I’ve seen seven-figure founders with no personal wealth.

They worked hard. They had great teams. They grew fast. But they never turned their business into an asset.

Without systems, recurring revenue, and founder independence, the valuation suffers. And if something unexpected happens, the business can’t sustain itself—let alone sell well.

Your Next Step

If you’re in Revenue or Profit mode, that’s okay.

But if you started this business for freedom and wealth—not just income—start planning your transition to Valuation Mode.

And if you’ve been in business for 10, 20, even 30 years, remember: These phases are not about time. They’re about intentional design.

I’ve seen decade-old businesses stuck in Phase 1, and newer ones move through all three phases in 3–5 years with intentional design.

If you’re deciding on a new growth strategy—or evaluating a big project a client just offered—ask:

“Will this move increase the enterprise value of my business?”

If it improves margins, deepens positioning, or strengthens systems—lean in.

If it just adds complexity, load, or dependence on you—pause.

Redesign before you say yes.

Growth isn’t the enemy.

But growth without direction will cost you far more than it gives. Always, move forward by design.

What This Looks Like in Practice

I’m not a valuation analyst or a finance coach.

I’m a hard-core operator who’s sold two companies. I’ve sat across from buyers, faced their auditors and lawyers and navigated due diligence.

I know what makes a buyer say yes—and what makes them walk away.

Valuation isn’t an event.

It’s a way of building—with clarity, leverage, and intention.

If you want a partner in that process—someone who’s been there—this is the work I do every day.

📚 From My Bookshelf:

Actionable insights from books that transformed me and how I built.

“It’s just common sense!”. I used to say this a lot.

But as my team and business started growing, simple mistakes started costing us big.

Why? Because we relied on:

- Memory instead of systems.

- Experience instead of process.

- “Common sense” instead of checklists.

Pilots use checklists. Surgeons need them. NASA depends on them. Why don’t we have them in our businesses?

Read how checklists transformed our operations here.

Thank you for being here, I will see you next Thursday.

To building a high-value, founder-free business,

Surabhi

PS: One of the most basic prerequisites for a higher valuation?

The business must be able to run—and grow—without the founder at the center.

That’s exactly what Founder’s Freedom Blueprint helps you build.

It gives you the exact systems to reduce founder dependency and increase enterprise value—without hiring a giant team.

Join here — $127 for lifetime access + monthly Q&A support.

PPS: Reply and tell me: Which phase are you in—and what’s keeping you there?

I read every response. And I’ll be turning these into future deep dives.