Business is simple.

There are only three ways to grow:

- Get more customers.

- Get those customers to pay you more.

- Get those customers to stay longer.

That’s Jay Abraham’s timeless principle.

It’s true. But it’s not the full story.

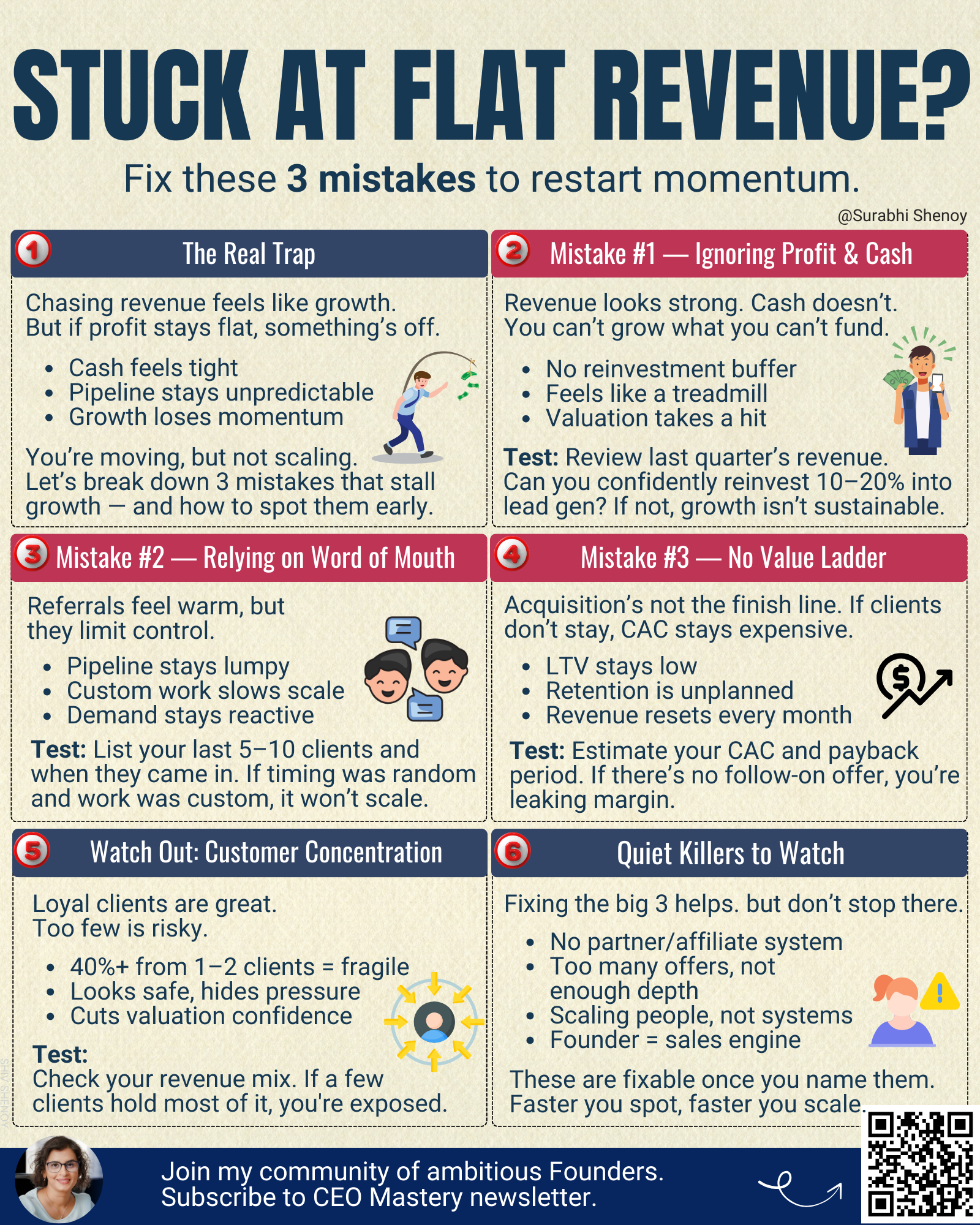

Because while founders are obsessed with chasing revenue, here are the 3 mistakes I see most often.

Mistake 1: Ignoring Profit & Cash Flow

Topline feels good. But it doesn’t fund growth.

Without profit and strong cash flow, you can’t reinvest in marketing, sales, or delivery.

Revenue without cash reserves = treadmill growth.

And here’s the valuation truth: buyers discount revenue if the business isn’t spitting cash predictably.

Do this 5-Minute Exercise:

Find out if your revenue can fuel growth.

- Review your P&L or cash flow for last month/quarter.

- Look at your marketing and lead gen spend.

- Can you afford to increase it by some percentage?

Ask: “If I reinvested just 10–20% into marketing or lead generation, what would that mean for next quarter’s growth?”

Mistake 2: Relying on Word of Mouth Alone

Many B2B founders pride themselves on WoM.

But here’s the problem: it’s unpredictable.

It dries up when markets shift.

It keeps you stuck in feast–famine cycles.

Word of Mouth can be a bonus. But if it’s your only growth engine, you don’t have a business strategy. You have a hope strategy.

Quick check (takes 5 minutes):

Spot the inconsistency in your pipeline.

- List your last 5–10 new clients and the month they were acquired.

- For each, answer these questions:

1. Was the business volume consistent month to month? (i.e., steady flow vs. dry spells)

2. Did you deliver the same type of project, or were you customizing each time?

If your answers are mostly “no” and “custom,” your growth isn’t repeatable — it’s reactive.

Mistake 3: Not Building a Value Ladder

Most founders work hard to acquire customers… and then stop. You should acquire a client and have a system to keep them for a lifetime.

That’s a solid value ladder.

Once you figure this out, every marketing and investment decision becomes easier.

A word of caution:

Watch out for customer concentration.

If 40% of your revenue depends on just one or two clients (no matter how long they’ve been with you), you’re exposed. Loyalty feels safe, but in reality it slashes valuation and adds tremendous risk.

Take this 5-minute test:

- Write down your customer acquisition cost (or your best estimate).

- Then ask: “How many months/years of revenue from a single client does it take to justify this spend?”

If you don’t have offers that keep clients longer, your acquisition costs will always feel heavy. A value ladder pays for itself by extending LTV.

Beyond the Big 3: The Quiet Killers

I’ve highlighted the 3 biggest mistakes. But there are a few more I see often.

- No partner/affiliate system to generate leads consistently at lower CAC.

- Adding more products/services instead of strengthening one.

- Scaling “load” (people, effort) instead of “leverage” (systems).

- 100% founder-driven sales — with no repeatable process behind it.

The good news? Most are not very difficult to fix once you spot them.

This is exactly what we dig into during your Strategy Session.

What to expect in this power-packed session:

- Audit your current revenue levers.

- Spot the exact bottlenecks slowing scale or killing margin

- Design your next 90-day growth move — grounded in cash, not hope.

If you want to grow revenue that funds itself, without falling into these traps — book your call here.

The Bottom Line

Revenue growth isn’t about more hustle, more clients, or more offers.

It’s about smarter design:

→ Profit first.

→ Demand that scales.

→ Clients who stay (without concentration risk).

When you build on these principles, growth funds itself — without burning you out.

📚 From My Bookshelf:

Actionable insights from books that transformed me and how I built.

Book: Thinking, fast and slow:

I thought decision-making meant trusting my instincts.

Turns out, real clarity comes when I catch my brain playing tricks.

Daniel Kahneman taught me how two systems — fast intuition and slow reasoning — shape every choice we make.

In Outsmarting Your Brain, I share how I’ve flipped biased thinking into better business moves—by naming the traps, stepping back, and designing smarter routines.

Here’s a list of all books I have shared on this newsletter so far.

Thanks for being here. This is Edition #60. Milestone unlocked!

Here is to building for Profit, Freedom and Valuation,

Surabhi

P.S. Which of these mistakes feels closest to home right now? Hit reply — I’d love to know.