I’ve been studying Poor Charlie’s Almanack, a book about Charlie Munger, Warren Buffett’s lifelong business partner and one of the greatest investors in history.

And yes, I am studying it, not just reading. Taking notes, rereading passages, highlighter in hand.

It turns out the book isn’t really about investing. It’s about thinking clearly —about decisions, judgment, and building wisely.

Charlie had a disciplined ability to recognize businesses built to last.

The author distilled his multidisciplinary thinking into a framework of 10 filters for evaluating businesses. These filters separate companies that compound well from those that eventually implode.

Why this matters to you:

Every serious investor thinks through Charlie and Warren’s lens.

Most founders don’t, and that’s why they build businesses investors avoid.

If you ever plan to raise capital or exit, these principles will help you think like the people who’ll price your company.

If you’re simply scaling without an exit in mind, they’ll guide you toward more freedom, profit, and long-term success.

Either way, they separate companies that compound from those that collapse.

How Charlie Evaluated Businesses

Charlie Munger asked one question above all: Is this company likely to make money for a long time?

These filters work like decision frameworks. Each one draws from the diverse disciplines Charlie studied. Each helps separate businesses that achieve long-term success from those that merely looked promising.

For founders, this is a guide. A way to build a company that grows stronger and more profitable over time. The kind that eventually commands a higher valuation because it was built right.

Today, I’m covering the first 5.

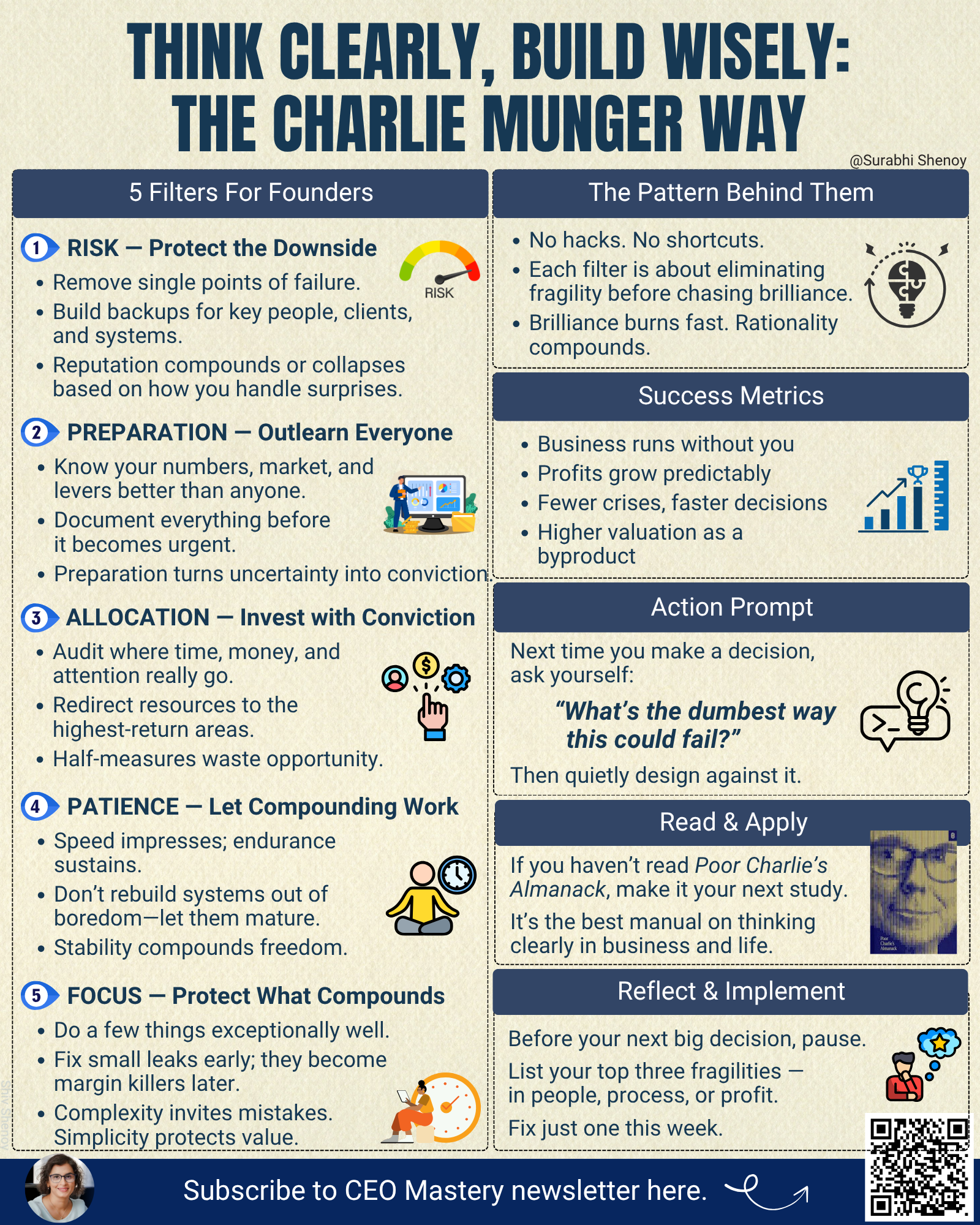

1. Risk

Every evaluation starts with risk, especially reputational.

Charlie avoided single points of failure. So should you.

Ask yourself: What happens if your top salesperson leaves tomorrow? If your main supplier goes bust? If your biggest client churns?

One founder I worked with lost a $2M deal because a key employee quit the week before close. No backup. No documentation. The deal died.

Build redundancy where it matters. Your reputation compounds, or collapses, based on how you handle the unexpected.

2. Preparation

Outperforming others starts with out-preparing them.

Charlie’s investments were successful because he’d read what others skimmed and guessed.

Know your numbers, your market, and your levers better than anyone else.

My acquirer cut my post-sale commitment from 12 months to 30 days because everything was documented, systematized, and ready to transfer. That’s preparation meeting opportunity. Read the full story here.

Preparation turns doubt into conviction.

3. Allocation

Capital — cash, time, attention — should flow to its highest return.

Most founders spread resources by habit: “We’ve always done X” or “Everyone does Y.”

When the math was clear, Charlie went all in. Half-measures waste opportunity.

Ask yourself: Where does an extra hour or dollar create the most value this quarter? Then ruthlessly redirect resources there.

4. Patience

Never take action for its own sake.

Let systems mature before rebuilding them. Most founders redesign too early because they’re bored, not because the system failed.

Charlie held See’s Candies for 50+ years. Not because it was exciting, but because it worked. Endurance creates stability. Stability compounds.

5. Focus

Charlie believed in ruthless focus: Do a few things exceptionally well rather than many things average. Every new initiative dilutes attention. Every product line you can’t support weakens the whole.

Keep your mission and metrics visible to everyone. Fix small leaks early, because they become margin killers later. I created a custom GPT that helps you identify hidden leaks and turn them into profit within hours. Read about it and access the GPT here.

Charlie avoided complexity not because he couldn’t handle it, but because it invited mistakes. Focus protects what compounds. Distraction destroys it.

If you haven’t read Poor Charlie’s Almanack, make it your next deep dive.

It’s not a book you read once — it’s one you study to think more clearly about business and life.

The Other Five Filters

The five filters—Risk, Preparation, Allocation, Patience, and Focus—are just the beginning.

Charlie’s approach includes five more:

- Independence: Most CEOs follow the herd. Charlie built wealth by thinking differently.

- Intellectual Humility: The most dangerous thing in business? Not knowing what you don’t know.

- Analytic Rigor: Busy founders confuse motion with progress. Charlie never did.

- Decisiveness: Hesitation kills more deals than bad decisions.

- Change: Markets shift. Your business must adapt without losing its soul.

Eliminate Stupidity Before Chasing Brilliance

Notice what’s missing from this checklist?

No “growth hacks.” No “10x thinking.” No shortcuts.

Every principle removes weakness instead of chasing strength.

He trained himself to see failure patterns earlier than most people noticed them.

Charlie believed the surest way to win long-term wasn’t to be brilliant. It was to stay rational, disciplined, and a little wiser than average, consistently.

His advantage came from preparation, patience, and discipline. Not from chasing brilliance.

Most founders chase new ideas. But compounding comes from restraint. Simplifying what’s complex, fixing what’s fragile, and avoiding what’s unnecessary.

Charlie won by not losing. You can too.

The next time you make a business decision, pause and ask: What’s the dumbest way this could fail?

Then quietly design against it.

Do that consistently, and brilliance will take care of itself.

Check out Part 2 here ->