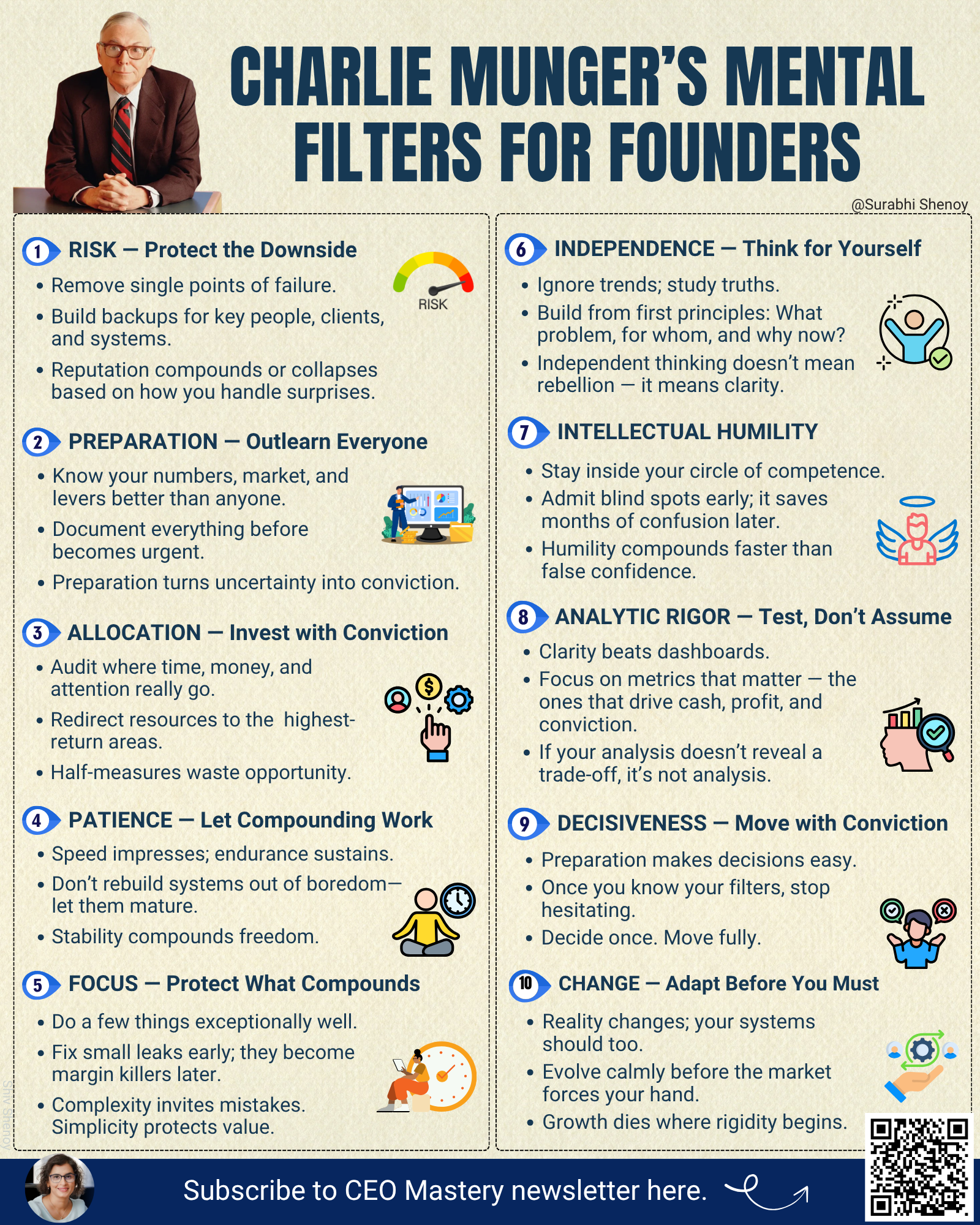

Last week, we explored the first five filters to help you build a company investors love and founders envy: Risk, Preparation, Allocation, Patience, and Focus. In case you missed it, read Part I here ->

This week, we’ll complete Charlie’s checklist with the filters that refine how you think, decide, and adapt as markets change.

Together, they show us why clarity and consistency outperform speed and hustle.

Let’s continue…

6. Independence

Charlie saw that independent thinking was the ultimate competitive advantage.

He and Warren often sat out entire investment cycles while the world chased trends. They didn’t care about being first — they cared about being right.

Many founders say they think independently, but their calendars, roadmaps, and pricing prove otherwise. They copy what’s “working in the market” — same funnel, same offer, same tone.

It feels safe. It looks smart. But it erases your uniqueness..

You don’t have to be rebellious to be independent.

You just need to build from first principles: What problem am I solving, for whom, and what proof do I have that it works specifically for them?”

Think independently. Do your own analysis. Take your time.

7. Intellectual Humility

Charlie and Warren built their empire by staying within their “circle of competence”.

When a new opportunity appeared — a hot stock, a trendy sector — they asked, “Do we truly understand this?”

If the answer was even slightly uncertain, they passed.

Founders struggle with this kind of restraint.

The pressure to appear confident to employees, investors, even themselves makes them fake certainty.

But when you pretend to know, you stop learning. And when you stop learning, small blind spots compound into big mistakes.

A SaaS founder I coach once admitted, “I’ve been avoiding my CFO’s questions because I don’t understand the model deeply enough.”

We spent a week breaking down his financial drivers — what actually moved revenue, cost, and cash. Once he saw how the pieces fit, his decisions got sharper. Within a quarter, he reduced CAC simply by focusing on the right levers.

When you name what you don’t know, you create space to learn, delegate, or decide better.

The fastest way to grow is by being honest sooner.

8. Analytic Rigor

Charlie didn’t rush decisions, he slowed them down until the facts were undeniable.

And when numbers didn’t support the story, he changed the story, not the numbers.

Most founders do the opposite.

They collect data to validate what they already believe.

At Tejora, we built a single-metric dashboard long before it was fashionable.

We tracked just three numbers: revenue per client, cash conversion, and profit per employee.

When those three stayed green, everything else followed. That focus gave us conviction, especially when deploying capital.

You don’t need more data. You need sharper questions.

Because when everyone tracks what matters, your entire company gets aligned like never before.

9. Decisiveness

Charlie often said, “Opportunities come infrequently. When it’s raining gold, put out the bucket, not the thimble.”

He and Warren made billion-dollar moves in minutes — not from impulse, but from preparation.

That’s the real secret to decisiveness. Preparation creates conviction.

Founders lose momentum not because they make bad decisions, but because they make none.

Once you know your filters — risk, return, and alignment — hesitation disappears.

Decisiveness doesn’t mean rushing.

It means you decide once and move fully.

Calm, strong decisions separate great operators from constant firefighters.

10. Change

Markets evolve. People change. The only constant is adaptation.

Charlie never worshiped old models. He was in constant search for better ways of thinking and changed his thinking the moment reality proved him wrong.

Great founders do the same.

They update processes before problems become crises.

They evolve offers, structures, and systems — not because the old ones failed, but because the market is shifting.

Change early. Change calmly.

Adapt before the market forces your hand.

The Compounding Mindset

Charlie’s genius wasn’t in predicting the future — it was in building a mind that could adapt to it.

He trained himself to stay rational when others panicked, humble when others boasted, and patient when others chased speed.

Apply these ten filters, and you’ll make fewer mistakes, and create a business that compounds freedom, profit, and valuation.

In short, eliminate stupidity, and brilliance will take care of itself.

📚 From My Bookshelf

Actionable insights from books that transformed me and how I built.

Book: Surrounded by Idiots

Thomas Erikson’s Surrounded by Idiots shows founders how to read personalities, adapt communication, and turn friction into fuel for performance.

It’s the playbook for leading a team that doesn’t think like you — and that’s exactly why it wins.

I broke down five lessons that help founders decode personalities, manage conflict, and build complementary teams that scale smoothly.

Here’s a list of all the books I have shared in this newsletter so far.

Note: This section contains affiliate links. Your purchase helps support the time and research that goes into each edition — thank you!

To lifelong learning,

Surabhi