After my second exit, I “launched” my coaching practice.

I posted a few times on LinkedIn.

I spoke to a few people.

I expected momentum.

I had real experience.

Results I could point to.

Frameworks I believed in.

And then… nothing.

Not zero — but nowhere near the pull I expected.

I felt confused.

A little embarrassed.

And if I’m honest — it felt unfair.

Because in my head, I had already earned the demand and the market wasn’t rewarding my past.

The Patience Gap

Most founder burnout is emotional.

And largely self-imposed.

It comes from misjudging time.

Founders put in effort and expect momentum.

They build, ship, and show up but results don’t.

Nothing looks broken.

Nothing looks right either.

That gap between effort and visible results?

That’s where frustration builds, and doubt creeps in.

This is exactly when unnecessary pivots happen.

Your great product can feel “unsellable” inside an impatient timeline.

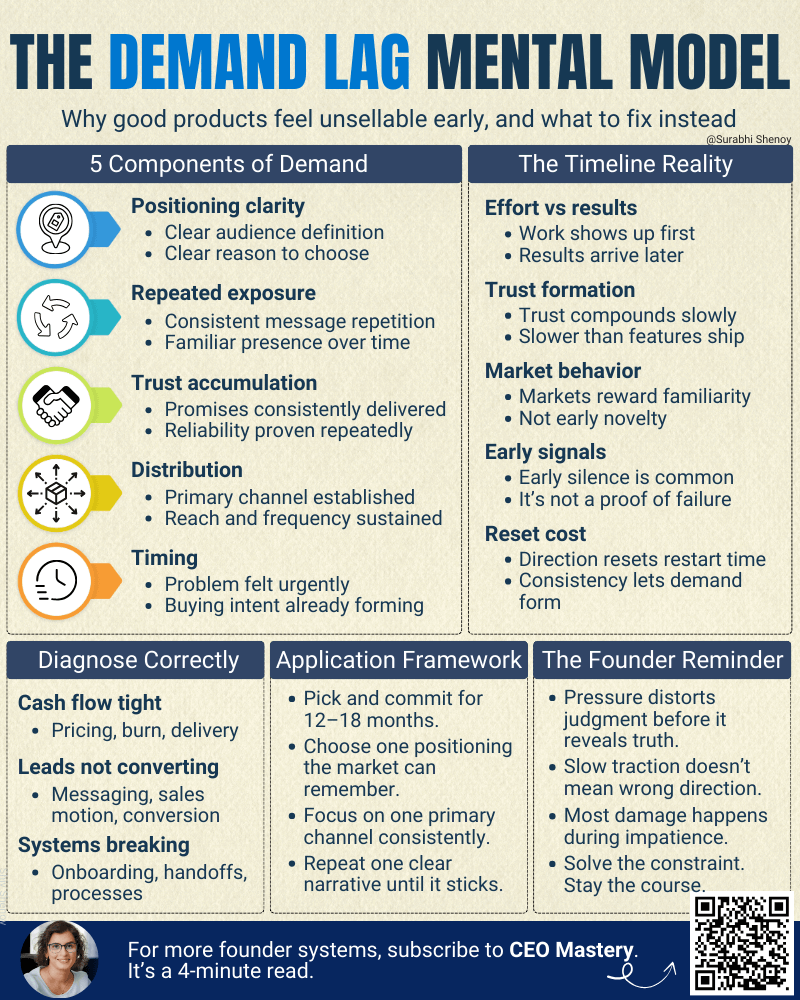

Mental Model: The Demand Lag

Studying iconic founders and companies made something uncomfortable clear:

Markets don’t reward novelty instantly.

They reward familiarity over time.

Trust compounds slower than features.

Distribution precedes demand.

What is a mental model?

A mental model is a framework for understanding how systems work—in this case, how market behavior responds to consistent effort over time. The mental model definition here is simple: demand isn’t immediate; it’s earned through repeated exposure and trust building.

The founders who win understand that demand isn’t a switch. Demand is a lagging indicator of:

- positioning clarity

- repeated exposure

- trust accumulation

- distribution

- timing

They stay long enough for the lag to resolve.

Nike: the long road before “Nike”

Nike didn’t start as Nike.

It was Blue Ribbon Sports from 1964 to 1971—seven years before the swoosh became a symbol.

In Shoe Dog, Phil Knight doesn’t teach tactics.

He teaches a lesson about timeline.

The Shoe Dog book chronicles Phil Knight’s journey building Nike from scratch. Nike wasn’t an overnight success—it’s story of perseverance through years of uncertainty. Phil Knight’s Shoe Dog reveals that: real demand came years after full commitment.

Not after the first campaign or clever positioning. But after a lot of repetition.

After staying in the lane long enough for the market to know what Nike meant.

Warren Buffett: trust before scale

Buffett started his first partnerships in 1956, he was just 25.

His early partnership letters show a long, disciplined period of trust-building and steady communication — before “Buffett” became a brand.

The point wasn’t stock picking.

It was consistency.

The operating principle: Credibility compounds when you stay visible and predictable over time.

Once you understand that demand is a lagging indicator, staying long enough stops feeling like faith — it becomes strategy.

The CEO takeaway

If you’re struggling to sell a great product…

The wrong question to ask is:“Why isn’t this working?”

A better question is:“Have we stayed in one lane long enough for the market to learn about us?”

Beyond product-market-fit, the hidden killer isn’t weak marketing.

It’s premature quitting during the Demand Lag.

Here’s the rule that now guides how I think about timelines:

Pick:

- One positioning (who it’s for + why you win)

- One primary channel (where you show up consistently)

- One narrative (the story you repeat until it sticks)

Then commit for 12–18 months.

Not in a rigid way.

In a learning way.

You can refine messaging.

You can improve packaging.

But you don’t reset direction every quarter.

The Part Most Founders Get Wrong Under Pressure

Staying on a path doesn’t mean the journey is smooth.

Real challenges will show up.

Cash flow will tighten.

Sales cycles will stretch—and long sales cycles will test your patience.

Marketing won’t convert as fast as planned.

Energy will dip.

These are execution problems — not direction problems.

This is where many founders make a costly mistake.

When sales don’t come fast enough, they change the product, the positioning, the messaging.

They change direction.

The correct response is more disciplined:

If cash flow is tight —

Reduce burn.

Optimize delivery.

Find short-term revenue relief.

Fix cash flow.

If leads are not converting —

Refine messaging within your positioning.

Improve your sales call scripts to handle objections better.

Train your sales team.

Fix marketing/sales execution.

If execution is breaking —

Improve onboarding.

Tighten processes.

Fix systems.

Fix what’s broken.

Don’t change direction under pressure.

Every strong business faced moments where continuing felt uncomfortable.

They didn’t change the mission.

They solved the constraint.

Closing

Accepting a longer timeline changed how I built.

I stopped trying to force demand.

I started building like I was brand new.

The result surprised me.

Demand showed up faster, because I stopped resetting the clock.

If you’re struggling to sell something great, I hope this helps you reframe how you think about timing, and brings a little calm to your approach.

Thank you for being here. CEO Mastery is growing fast, and it’s pushing me to think and write better every week — loving it.

I will see you next Thursday!

Surabhi

PS: If this shifted how you see demand and timelines, let me know here. I love to hear from you.