In 1971, Phil Knight felt like his business was about to collapse.

Nike, Blue Ribbon Sports at the time, was growing, but the pressure was closing in.

The bank had refused to extend the credit line any further.

And at the same time, Nike’s only Japanese supplier threatened to cut off supply after Phil refused their hostile acquisition offer.

Demand existed.

The product worked.

And yet, the company was one step away from failure.

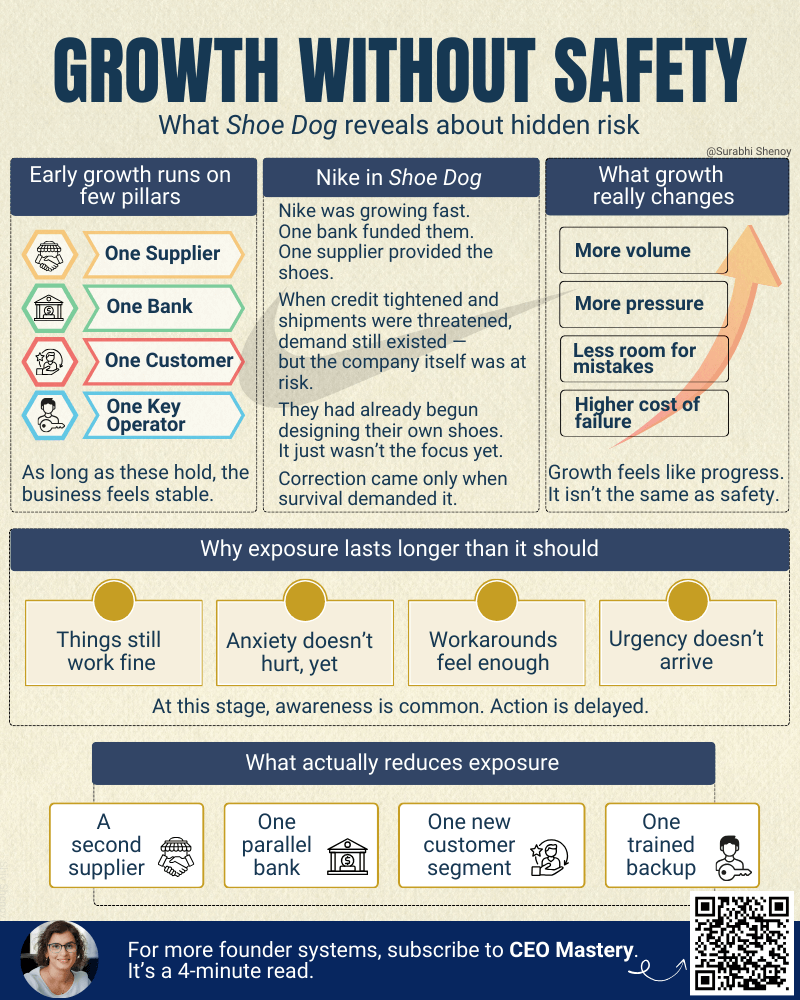

Growth Expands Exposure

Early businesses run on narrow dependencies.

One supplier.

One lender.

One major customer.

Sometimes, even one rockstar employee.

As long as those hold, the business appears stable. Founders want to grow and grow fast, because they believe growth will bring safety.

In reality, growth just changes the shape of risk.

More orders strain working capital.

More visibility exposes systems that you do not have yet.

More speed reduces the margin for error.

Early growth does not create safety.

It actually increases exposure.

Why Founders Live With Exposure Longer Than They Should

What stood out to me was how long Nike remained exposed.

When the bank refused credit, alternatives already existed.

A new bank had opened nearby.

A Japanese trading company operated across the street.

When the Japanese supplier threatened to stop shipments, Blue Ribbon had already begun designing its own shoes.

But it had not become the full focus.

The options were visible.

They just didn’t feel urgent yet.

Exposure was stressful, and Phil was fully aware of it.

But action/correction followed only when survival was challenged.

Seeing Myself in the Story

While reading this, I could clearly see myself in this story.

At one point in my business, just two customers accounted for nearly 70% of our revenue.

A private-sector bank represented around 40%.

The other was a large UAE-based company.

Within three months, both disappeared.

One ended our contract because their vendor policy changed, and the other collapsed due to circumstances outside our control.

I was fully aware of the exposure.

But at the time, most of my energy was going into keeping those two customers happy.

The alternatives existed.

Other markets.

Different customer profiles.

Clear ways to rebalance risk.

I pursued them only after there was no other choice.

The Pattern Beneath the Story

Founders usually recognize exposure early.

They learn to live with it.

As long as the business continues to function, exposure feels tolerable.

It creates anxiety, not urgency.

And this is the reason why they feel exhausted even when things appear to be working.

A Closing Reflection

Last week’s letter focused on time and patience.

This one is about what time does to risk.

When we start the business, risk and exposure that comes with it are necessary.

That’s what entrepreneurship is all about.

But then comes the time when founders need to start covering their bases.

As the business grows, exposure should either be reduced or actively managed.

If you don’t want to be the kind of business that rides the wave and then disappears, here is my invitation:

Sit with these questions:

- Where are you most exposed right now?

- What alternatives do you already know about?

- Can you commit to pursuing them before you are forced to?

If you were forced to act, you would figure it out.

Most founders do.

So “Just do it” today. Proactively. While you still have a choice.

Thank you for being here.

I will see you next Thursday!

Surabhi

PS: Phil Knight’s journey in Shoe Dog is a must-read to learn what it takes for a start-up to evolve into an iconic brand and why entrepreneurship is not for the faint-hearted.

PPS: If this helped you see risk and growth more clearly, let me know here. I’d love to hear what you have to say.