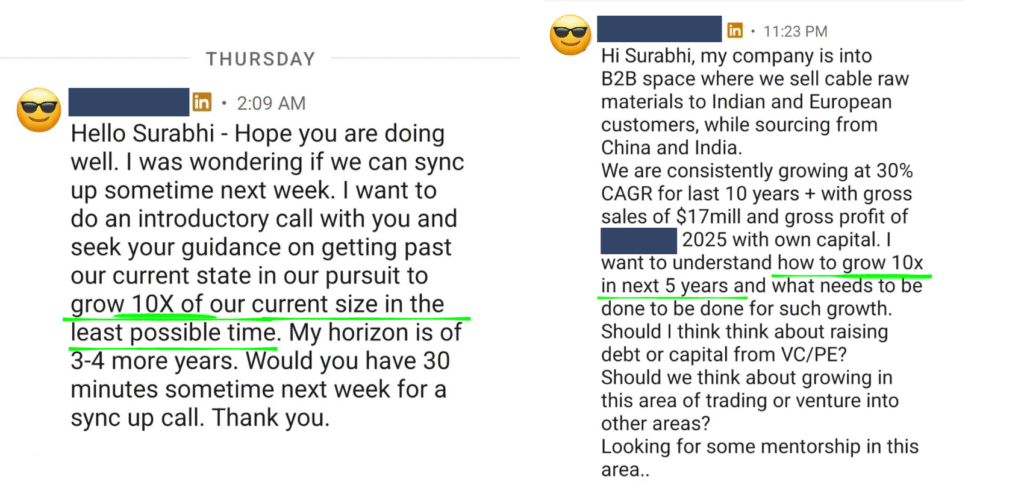

Over the past week, two founders reached out to me.

Different industries. Different stages. Same question.

“How do we grow 10x?”

I genuinely enjoy this question.

There is something energizing about ambition at that scale.

It signals intent, a refusal to settle for incremental progress, a willingness to think beyond the next quarter.

But over time, I have learned something important.

Ambition alone does not create 10x.

10x growth requires a different level of thinking — and a different level of execution.

First, the Thinking

Most growth conversations begin with tactics.

More leads.

More sales.

More hiring.

More expansion.

That is natural. We are operators and we default to action.

But 10x requires different mental models.

It begins with a definition:

10x of what?

Revenue?

Profit?

Enterprise value?

Personal wealth?

Freedom?

The answer shapes the path.

Once that is clear, the thinking deepens.

What drives value in this business?

What limits it?

What could break it at scale?

This thinking forces you to examine:

- The economic engine

- The primary constraint

- Risk concentration

- The end game

It asks uncomfortable questions.

- If revenue grows 10x but margin stays flat, have I created value?

- If the headcount grows 10x but dependency remains centralized, have I built an asset?

- If revenue grows but my valuation multiple shrinks, what did I actually build?

This new thinking requires stepping outside the operator’s urgency and looking at the architecture.

That is where clarity begins, and effort becomes focused.

Then, the Execution

Once thinking is elevated, execution changes.

Scaling becomes a question of math.

Before revenue grows, the economics need to be visible.

What is profit per customer?

Profit per unit or project?

How efficient is the cash cycle?

Where does capital get trapped?

Where does it generate the highest return?

Before complexity increases, dependency needs to decrease.

Is the system reliant on a few customers?

A few key employees?

The founder’s constant involvement?

If those risks remain, scale increases pressure.

When they are reduced, growth becomes predictable.

You can see how much capital is required.

You can determine what margin expansion is necessary.

You can build leadership capacity intentionally.

Execution becomes structured and deliberate, not heroic.

Where Most 10x Plans Break

Wanting 10x is common.

Defining it precisely is not.

The difference shows up in how decisions are made today.

Founders who scale successfully know what they are multiplying.

Revenue alone is not the goal. Margin, valuation, ownership structure, and optionality matter just as much.

I have posed many questions in this edition.

The answers will not be obvious. They will demand deeper thinking, better data, and a willingness to get uncomfortable.

That examination is where meaningful scale begins.

PS: This is the work I do with founders preparing for their next phase of growth. We examine the economics, reduce dependency risk, and design the business so 10x growth becomes an outcome. If you are thinking seriously about 10x, reply and tell me what you are building and where you intend to take it.