When I was selling my tech company, I got an unexpected offer from outside the industry.

It came from a father-son duo who ran a Chartered Accounting firm.

They weren’t in tech. But the son had a clear vision.

“We’ve spent years watching tech reshape every industry — including ours.

I don’t want to miss the next wave.

We could build something… but we’d rather buy what’s already working.”

It was a smart move.

Instead of spending years building, hiring, and testing…

They were looking to acquire a profitable tech business and scale with confidence.

They were buying time, certainty, and momentum.

It was my first real glimpse into the Buy versus Build mindset.

Today?

It’s no longer rare.

It’s smart.

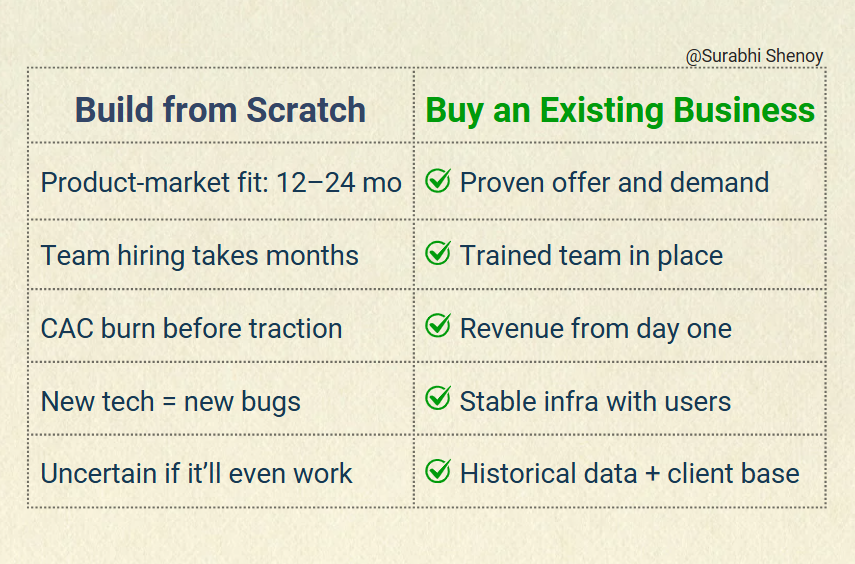

Most founders believe there are two options:

- Start from zero

- Or never start at all

But there’s a third path — one that gets you revenue, product, and team on Day 1.

That’s what buying unlocks.

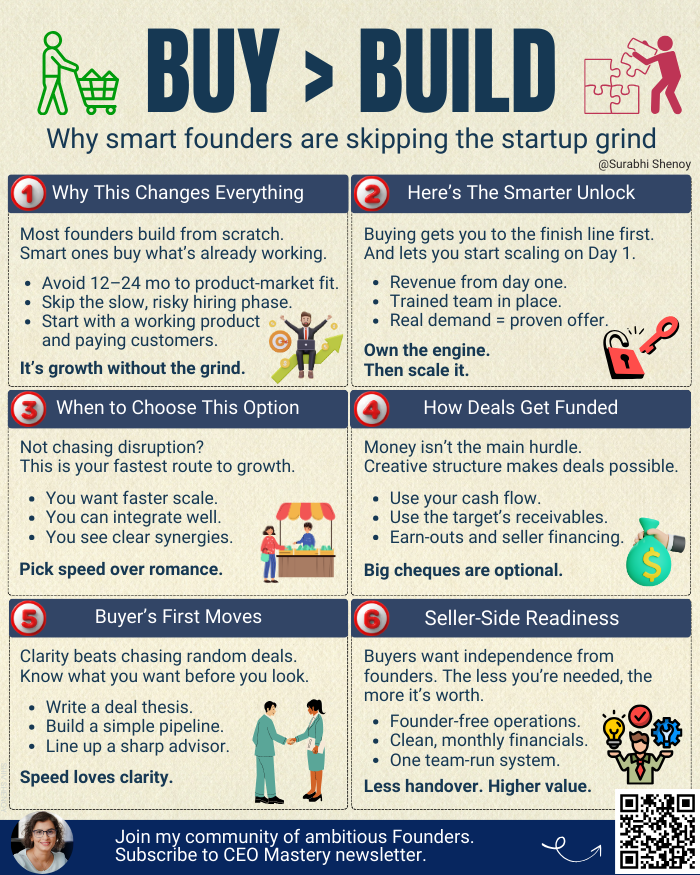

Why More Founders Are Choosing to Buy

Founders, operators, even creators — many are skipping the startup route and choosing to buy an existing business instead.

Here’s why it’s catching on:

If you’re not chasing a bold, disruptive vision —

then why go through the pain of starting from zero?

In many cases, you don’t even need to pay 100% money upfront.

But Where Will I Get the Money?

This is the question I hear most.

The good news?

Institutional financing exists — especially in the U.S., where banks routinely fund acquisitions just like property purchases.

In other markets like India or UAE, while bank loans are less accessible, many deals today use:

- Leverage from your existing business (cash flow, assets, credit lines)

- Book debts of the acquisition target as collateral

- Earn-outs and phased buyouts — you pay as you grow

- Seller financing — yes, it’s more common than you’d think

Buying isn’t only for PE firms anymore.

Founders like you and me are doing it every day.

You don’t need millions in the bank.

You need the right mindset — the right structure — and maybe, the right advisor.

Hint: You already know where to find her. 😊

If you’d like a deeper dive into acquisition funding, reply with “Finance” and I’ll cover it in an upcoming edition.

Whether You’re Scaling or Selling — This Matters

Because one day, someone like that father-son duo could want to buy your company.

But only if it has:

- Founder-free operations

Read: My acquirer slashed my post-sale commitment from 12 months to 30 days. Here’s why. - Clean numbers and strong financial foresight

Read: The Million-Dollar Blindspot: Turning Financial Foresight into Your Superpower - A management system that’s run by team

Read: The system that saved my sanity (and my company)

So even if you’re not on the buying side…

Start building something someone else would want to buy.

And if you’re planning to expand — acquiring a complementary business might be your next best move.

Don’t worry if you’re not there yet, now you know what to aim for.

Founder-to-Founder Deal Flow

I’ve quietly started matching founders who want to sell with those who want to buy.

If you’re considering acquiring or exiting in the next 1–2 years:

📬 Fill this 2-min form to stay on my radar. I’ll reach out if there’s a match.

Everything stays confidential. Always.

📚 From My Bookshelf:

Actionable insights from books that transformed me and how I built.

Book: The Hard Thing About Hard Things

I thought leadership meant having all the answers.

Turns out, it’s often just staring at the questions — out loud.

Ben Horowitz taught me that the real hard thing isn’t bold goals.

It’s layoffs.

It’s entitlement.

It’s waking at 2 a.m. regretting your decisions.

In this article, Command Without Cracking, I share how I learned to face those moments with clarity, humility, and a hint of grit.

Here’s a list of all books I have shared on this newsletter so far.

My top content from last week

It’s called “5 signs your mood is running your business.” A quick read on how a leader’s energy can quietly shape — or sink — sales, morale, and culture. Read it here. Until next week,

Build smart | Create wealth

Surabhi