“We need you to stay for a year after acquisition.”

That sentence is every founder’s exit nightmare.

When I sold my tech company, I heard those exact words.

Buyers were nervous—what if my business collapsed without me?

But something unexpected happened.

During 80 days of intense due diligence, my post-sale commitment shrank from 1 year to 6 months, and then to just 1 month.

Why?

Because buyers realized the company wasn’t dependent on me.

- The systems ran without my daily involvement.

- The clients stayed because of the brand and team—not me.

- The sales pipeline filled automatically and was fulfilled on a conveyor belt.

I was there, but I wasn’t needed.

Result? It sealed the deal AND freed me much sooner than expected.

This wasn’t luck – it was intentional design.

Scaling isn’t just about valuation—it’s about stepping into your role as a true CEO.

The more your business depends on you, the less time you have to lead. The key to long-term success is designing a company that runs without you—so you can work on growth, not daily fire-fighting.

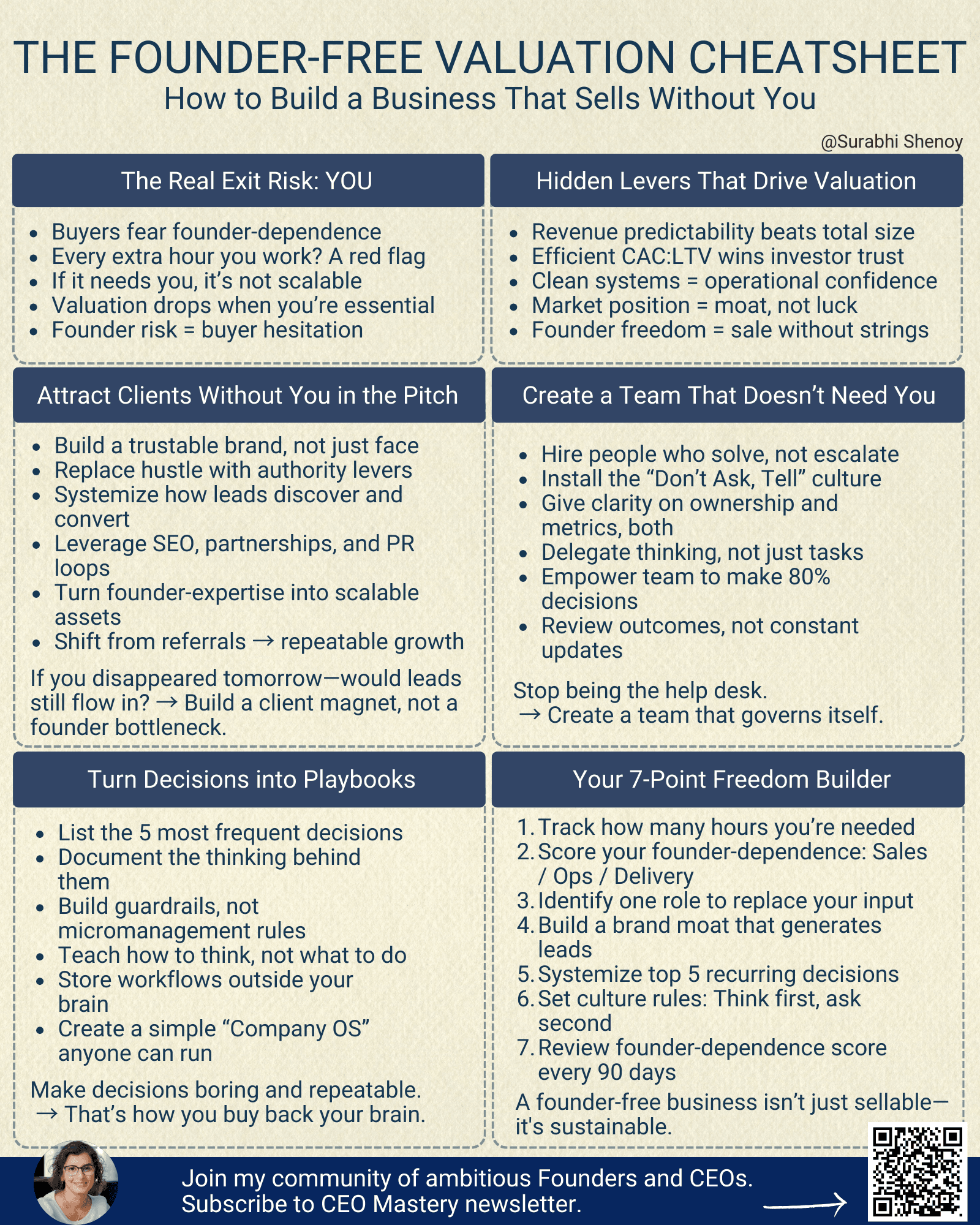

Why Some Companies Sell for 10X Multiples—And Others Struggle to Hit 3X

Most founders think valuation is about revenue or profitability.

But investors look deeper.

These 5 hidden valuation drivers matter just as much as EBITDA

- Revenue Predictability

Recurring revenue is king. A $5M ARR company with 90% retention is worth more than a $10M company with inconsistent cash flow. - Customer Acquisition Efficiency

Your CAC:LTV ratio shows whether your revenue is sustainable. - Operational Maturity

If your systems are a mess, buyers see a risky purchase, not a business. - Market Positioning

Are you a commodity or a category leader? Defensibility drives valuation.

Founder Freedom

Can the company run WITHOUT you? If not, you’re selling a job, not a business.

The Hidden Cost of Founder Dependency

Acquirers ruthlessly test one thing:

“Are we buying a business, or are we buying YOU?”

Here’s what gets scrutinized:

- How many client relationships rely on you personally?

- How many strategic decisions require your approval?

- How much technical knowledge exists only in your head?

- How involved are you in the sales process?

Each of these adds risk for a potential buyer.

The more the company needs you, the lower your valuation*.

📉 Founder-dependent companies → Sell for 2-3X EBITDA

📈 Founder-free companies → Sell for 6-10X EBITDA

And even if you’re not selling, founder dependency = burnout.

* Valuation multiples vary widely based on industry, growth rate, profitability, market conditions, and the specific deal structure. These figures represent general trends observed in private company sales but are not a one-size-fits-all formula.

Why This Matters—Even If You’re Not Selling

Even if you have no plans to exit, founder dependency limits growth, makes scaling harder, and increases stress.

When your business can operate without your daily input:

- You have more time to focus on long-term strategy.

- Raising capital happens on your terms, not out of necessity.

- Economic downturns become manageable instead of existential threats.

- You gain peace of mind, knowing everything doesn’t depend on you.

I’ve worked with founders who went from burned-out operators to strategic leaders simply by reducing founder dependency. Their businesses became more valuable—and so did their time.

How to Build a High-Value, Founder-Free Business

Start here:

1. Build a Client Magnet (Instead of Being the Sales Engine)

If YOU are the #1 salesperson, your business has a valuation cap.

- Turn expertise into brand leverage—so clients trust the business, not you.

- Build repeatable growth levers—partnerships, media, and authority.

- Differentiate—inbound demand beats outbound hustle.

Action Step:

If you disappeared tomorrow, how would leads still come in?

Your #1 task this quarter: Shift from founder-led sales → system-driven sales.

2. Create a Self-Governing Team (That Thinks Like Owners)

If your team always asks for approval, you’re the bottleneck.

- Hire problem solvers, not just task executors.

- Use The Don’t Ask, Tell Rule—Decisions come with solutions, not questions.

- Set clear ownership metrics—no founder approval needed.

Action Step:

Shift from “I approve everything” → “I set outcomes, they execute.”

3. Systematize Decision-Making (So Growth Doesn't Depend on You)

Most founders hate process-building. But Process = Valuation Growth.

- Create decision playbooks—so that judgment is consistent without you.

- Document critical workflows—so knowledge isn’t locked in your brain.

- Build a Company OS—so execution doesn’t require daily input.

Action Step:

- Write down the top 5 decisions your company makes weekly.

- Build a Decision Guide—so your team knows what to do without asking you.

The Founder's Freedom Blueprint Course

I built the Founder’s Freedom Blueprint after seeing too many brilliant entrepreneurs create valuable products but low-value businesses.

By implementing my system, founders consistently see higher valuations and reduced work hours within 90 days.

If you want to build a high-value, founder-free business, the step-by-step blueprint is inside The Founder’s Freedom Blueprint video course.

To your success,

Surabhi

P.S. What’s the biggest thing keeping you stuck in daily operations? Hit reply and let me know—I read every response.