Last week, I sat across from a tech CEO whose company had just launched a game-changing product. His eyes lit up as he detailed the innovative features.

Then I asked a simple question: “What’s your projected revenue for the next quarter?”

The enthusiasm drained from his face. He fumbled for words, eventually admitting he wasn’t sure.

This scene has played in my coaching conversations more times than I can count.

Brilliant minds, building the future, blind to the very numbers that will determine their fate.

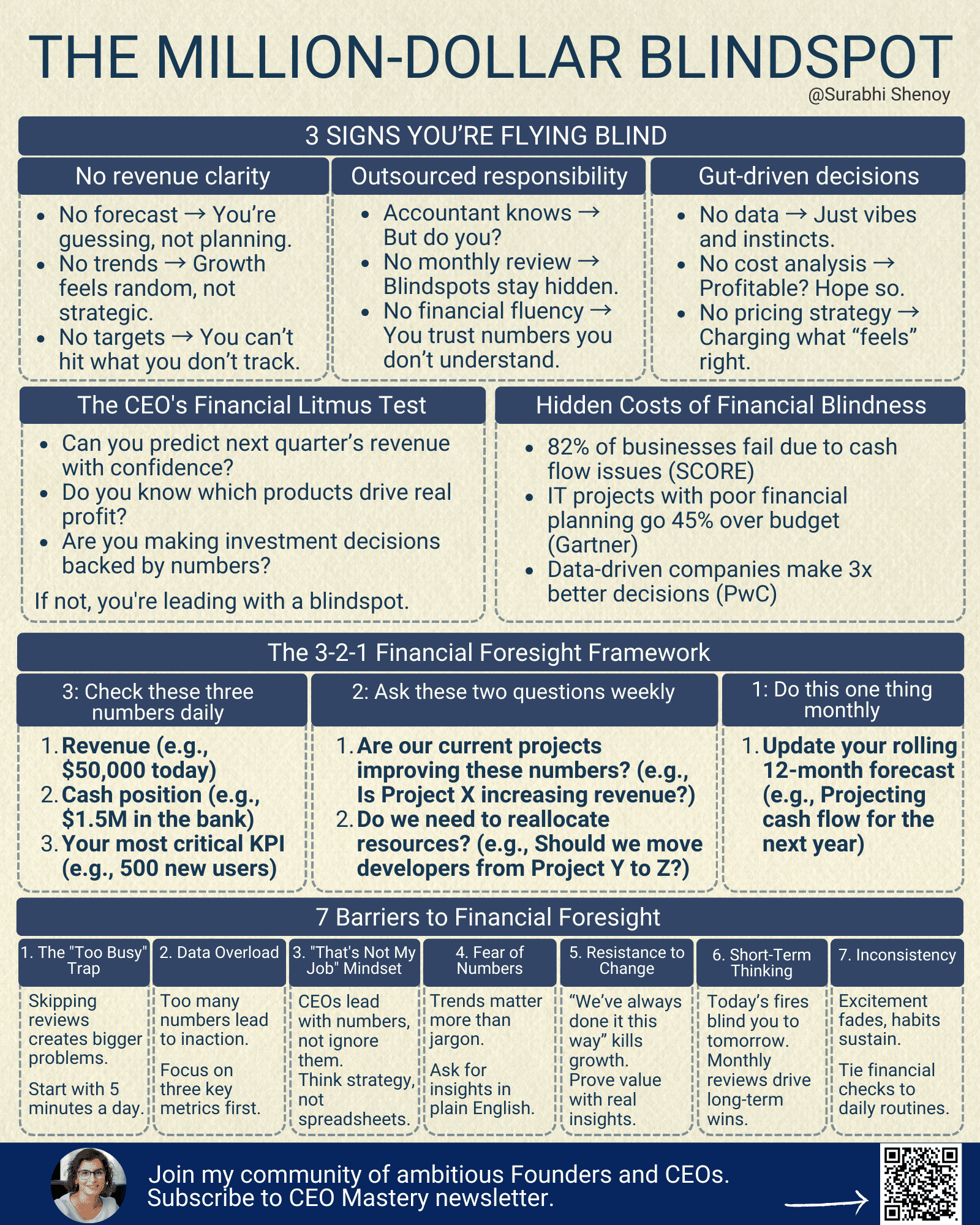

It’s what I call the Million-Dollar Blindspot.

The High Cost of Financial Blindness

“But I have an accountant for that,” you might say. Or, “I’ll focus on finances once we’ve hit our growth targets.”

These are comforting thoughts. They’re also dangerous ones.

Consider this:

- 82% of businesses fail due to cash flow problems, not product issues (SCORE.org).

- IT projects with poor financial planning go 45% over budget and deliver 56% less value (Gartner).

- Data-driven companies are 3x more likely to make better decisions (PwC).

Financial blindness isn’t just risky. It’s expensive.

The Power of Financial Foresight

Now, let’s flip the script.

Imagine knowing exactly:

- How your current projects impact your bottom line

- Which of your products or services are truly profitable

- Where you can afford to invest in innovation

This isn’t just about avoiding failure. It’s about supercharging your success.

In my year of coaching, I’ve seen tech leaders with financial foresight:

- Make strategic decisions 2x faster

- Grow their companies a lot more efficiently

- Outperform their market segments by charging higher pricing.

Financial foresight is more than a safety net.

It’s the rocket fuel driving your business forward.

Let’s continue exploring how to get out of the Million Dollar blindspot.

The 3-2-1 Financial Foresight Framework

Financial foresight is a skill you can develop. And it doesn’t require an MBA.

I’ve distilled the practices into a simple, 3-2-1 Financial Foresight framework.

Here’s how it works:

(below is an example; make it yours)

Check these THREE numbers daily:

1. Revenue (e.g., $50,000 today)

2. Cash position (e.g., $1.5M in the bank)

3. Your most critical KPI (e.g., 500 new users)

Ask these TWO questions weekly:

1. Are our current projects improving these numbers? (e.g., Is Project X increasing revenue?)

2. Do we need to reallocate resources? (e.g., Should we move developers from Project Y to Z?)

Do this ONE thing monthly:

Update your rolling 12-month forecast (e.g., Projecting cash flow for the next year)

That’s it.

Your own 3-2-1.

Daily. Weekly. Monthly.

Simple, yet profound as you implement.

The 7 Barriers to Financial Foresight (And How to Break Through)

Here are the most common barriers I’ve seen tech CEOs face when implementing financial foresight and how to overcome them:

1. The "Too Busy" Trap

You say: “I’m too busy for financial reviews.”

Reality: Skipping them will only cost you more time later.

Solution: Start with 5 minutes a day. That’s it. Five minutes to check your three key numbers.

2. Data Overload

You see: An ocean of numbers.

You need: A clear stream of insights.

Solution: Focus on only three metrics to start. Expand gradually.

3. The "That's Not My Job" Mindset

You think: “That’s my CFO’s job.”

Truth: Financial foresight is a leadership tool, not an accounting task.

Solution: Reframe it as strategic thinking, not number crunching.

4. Fear of Numbers

You feel: Intimidated by financial jargon.

You need: To focus on trends, not terminology.

Solution: Ask your team to explain in plain English. Understanding patterns matters more than knowing every term.

5. Resistance to Change

Your team says: “But we’ve always done it this way.”

You say: “Let me show you a better way.”

Solution: Demonstrate the insights you gain. Let the results speak for themselves.

6. Short-Term Thinking

You focus on: Today’s emergencies.

You need to consider: Tomorrow’s opportunities.

Solution: Use your monthly review to connect present actions to future outcomes.

7. Inconsistency

You start: With enthusiasm.

You stop: When it gets tough.

Solution: Link financial checks to existing habits. Review numbers with your morning coffee.

Remember: Each barrier you break through brings you closer to financial clarity.

Start small. Stay consistent.

Very soon, you will start seeing patterns emerging in your finances – that will be your superpower.

Your Next Move

Here’s how to start developing your financial foresight today:

- Daily: Set a recurring 5-minute appointment to check your three key numbers.

- Weekly: Schedule a 30-minute meeting (with yourself or your team) to ask those two crucial questions.

- Monthly: Block out 2 hours on the first Tuesday of each month for your 12-month forecast review.

Your technical expertise got you where you are. Financial foresight will take you where you want to go.

It’s time to close your Million-Dollar Blindspot.

Thanks for being here, and I’ll see you next Thursday.

Surabhi

P.S. If you’re ready to explore how we can work to improve your financial acumen together, let’s chat. Book a clarity call with me.

Ready to master your CEO game?

Here are 2 ways I can help

1) Elite CEO Coaching:

Strategic support to scale systematically

→ Book Your Free Clarity Call

2) 1:1 Strategy Session

One focused hour. Clear action plan. Immediate implementation.

→ Get a Power Hour With Me