Your brain is sabotaging your business decisions.

That might sound harsh, but it’s true.

I’ve always been fascinated by how our minds work. When I read ‘Thinking, Fast and Slow‘ by Daniel Kahneman, it changed how I make every business choice.

The book reveals that our decisions are often ruled by hidden biases, not logic.

The Two Systems That Drive Our Thinking

Kahneman explains that we have two thinking systems:

System 1: Fast, automatic, emotional, and works on autopilot

System 2: Slow, logical, deliberate, and requires effort

Most of the time, we use System 1 for business decisions because it’s easier. But this leads to mistakes that cost money and opportunities.

Five Thinking Traps That Harm Your Business

Let me share the five biggest decision traps I’ve spotted in my own business thinking – and how I’ve learned to fix them:

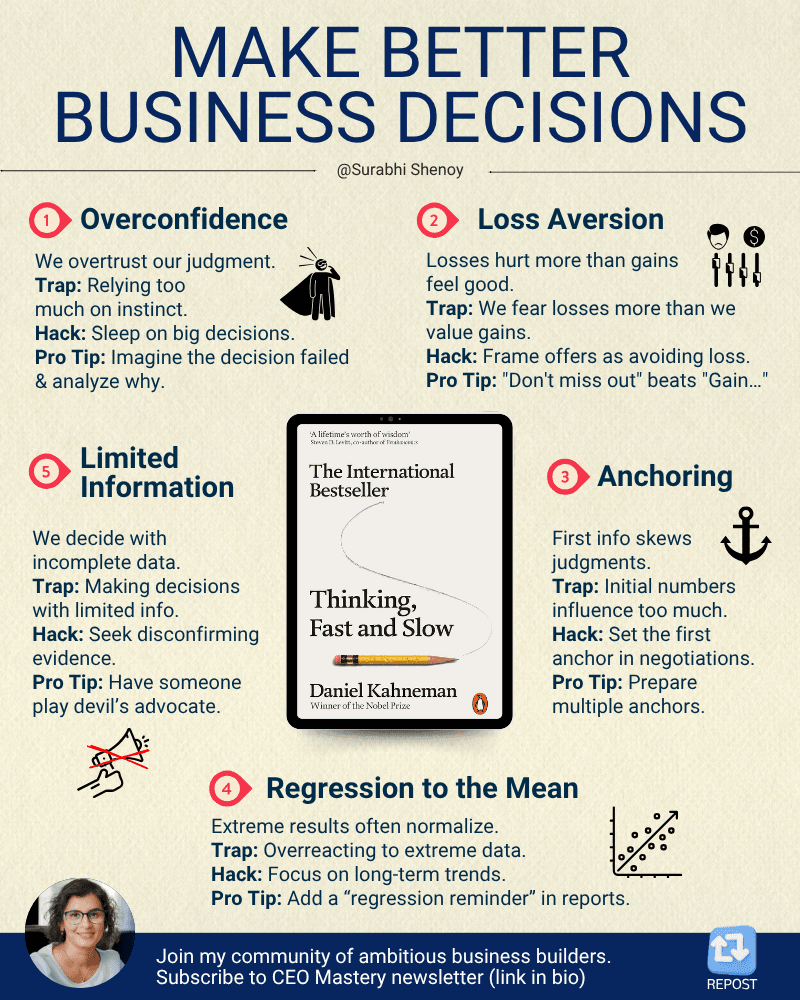

1. Overconfidence

What happens: We overtrust our judgment.

The trap: Relying too much on instinct.

We all think we’re right most of the time. This blinds us to risks and alternatives.

The fix:

- Sleep on big decisions

- Imagine the decision failed and analyze why

- Write down reasons why you might be wrong

I now question my instincts before any big move. For important decisions, I force myself to list three ways I could be mistaken.

2. Loss Aversion

What happens: Losses hurt more than gains feel good.

The trap: We fear losses more than we value gains.

Losing $100 feels worse than gaining $100 feels good. This makes us too cautious with changes that might have big payoffs.

The fix:

- Frame offers as avoiding loss rather than making gains

- Remember that “Don’t miss out” beats “Gain this” in your messaging

- Consider if you’re saying no just to avoid a potential loss

This insight reshaped my pricing strategy. I now emphasize what customers might lose without our service, not just what they’ll gain.

3. Anchoring

What happens: First info skews judgments.

The trap: Initial numbers influence too much.

The first number you hear becomes your mental anchor for what’s “reasonable.”

The fix:

- Set the first anchor in negotiations

- Prepare multiple anchors for important discussions

- Question the first number you hear from others

I use this to set favorable starting points in client proposals. The initial price frames everything that follows.

4. Regression to the Mean

What happens: Extreme results often normalize.

The trap: Overreacting to extreme data.

After an unusually good or bad period, results typically move back toward average. But we create stories to explain these natural swings.

The fix:

- Focus on long-term trends, not outliers

- Add a “regression reminder” in reports

- Don’t change strategy based on one extreme month

This helps me avoid overly optimistic forecasts after great quarters. I know that some pull-back is normal, not a sign that something’s wrong.

5. Limited Information

What happens: We decide with incomplete data.

The trap: Making decisions with limited info.

We form conclusions from the information in front of us, often missing critical facts.

The fix:

- Seek disconfirming evidence

- Have someone play devil’s advocate

- Ask “What information am I missing?”

I now actively seek diverse perspectives, especially those that challenge my thinking. This has saved me from several costly mistakes.

How To Apply These Insights In Your Business

Knowledge isn’t enough – you need a system to apply these insights. Here’s my process:

For Major Decisions

- Identify which thinking system you’re using Ask: “Am I making this decision on autopilot or with careful analysis?”

- Recognize potential biases Which of the five traps might be influencing this particular decision?

- Create a bias checklist Before finalizing, run through questions like:

- Am I being overconfident?

- Am I avoiding loss rather than seeking gain?

- Am I anchored to an initial number?

- Is this an outlier that will likely regress?

- What information might I be missing?

Seek outside perspective Find someone who can spot your blind spots.

For Daily Decisions

Even small choices add up. For routine decisions:

- Build in pauses A short break activates your System 2 thinking.

- Create decision rules Pre-made rules help bypass biases for common situations.

Track decisions and results Review what worked and what didn’t to improve your process.

Who Should Read This Book

“Thinking, Fast and Slow” is essential reading for:

- Business owners who need to make high-stakes decisions regularly

- Investors looking to avoid emotional decision traps

- Team leaders who want to improve group decision-making

- Marketers who need to understand how customers really make choices

- Anyone who negotiates as part of their work

While the book is dense (499 pages of research), the insights are worth the effort. Understanding these mental traps has saved me from many expensive mistakes and helped me spot opportunities others miss.

The most valuable business asset isn’t capital or connections – it’s clear thinking. This book helps you achieve that.

And if you’d like to Explore More Strategic Frameworks From My Bookshelf, you might find these interesting:

The Checklist Manifesto – Combat cognitive biases with simple systems that overcome “overconfidence” and “limited information”

The 7 Habits of Highly Effective People – Develop the proactive mindset needed to overcome reactive decision-making traps