Neither of my exits was planned.

Not the first. Not the second.

I didn’t start either company with an exit in mind. I was building for the long haul.

But life had other plans.

One exit was sparked by an opportunity I couldn’t ignore.

The other by a personal loss I couldn’t avoid.

Two Businesses. Two Very Different Stories.

In 2003, we started a tech company.

In 2007, we started a fitness business.

By 2012, I exited the fitness company.

In 2021, I exited the tech one.

So, you can see for five years in between, I was running two high-growth companies at the same time—juggling scale, systems, and my sanity.

And while neither exit was “planned,” how I had built them made all the difference. Let me explain…

What Happened in Exit #1

The fitness business attracted a buyout offer. It was compelling and unexpected. And the opportunity in the other tech business was far bigger. So I sold.

At the time, the business was:

- Operationally sound

- Founder-independent in the last two years

- Built on systems I now teach in the Founder’s Freedom course

But, I wasn’t prepared for an exit. I didn’t have a valuation mindset—just an execution mindset. I wasn’t optimizing for financial outcomes.

The sale happened because the business was running well, and the buyer wanted to enter the market.

But the valuation? I could have done better. I had built a good business. But not a strategic asset.

Well…no regrets. It was a massive learning.

What Happened in Exit #2

In 2021, I sold my tech company. It was a very different experience.

The trigger wasn’t strategic—it was deeply personal. My husband and co-founder passed away. After that, I couldn’t see myself building it alone.

Once I decided to exit, I gave myself a three-year runway.

I stopped thinking like a founder. I started thinking like a buyer. I focused completely on increasing enterprise value.

This time, I was intentional. I knew what drove valuation.

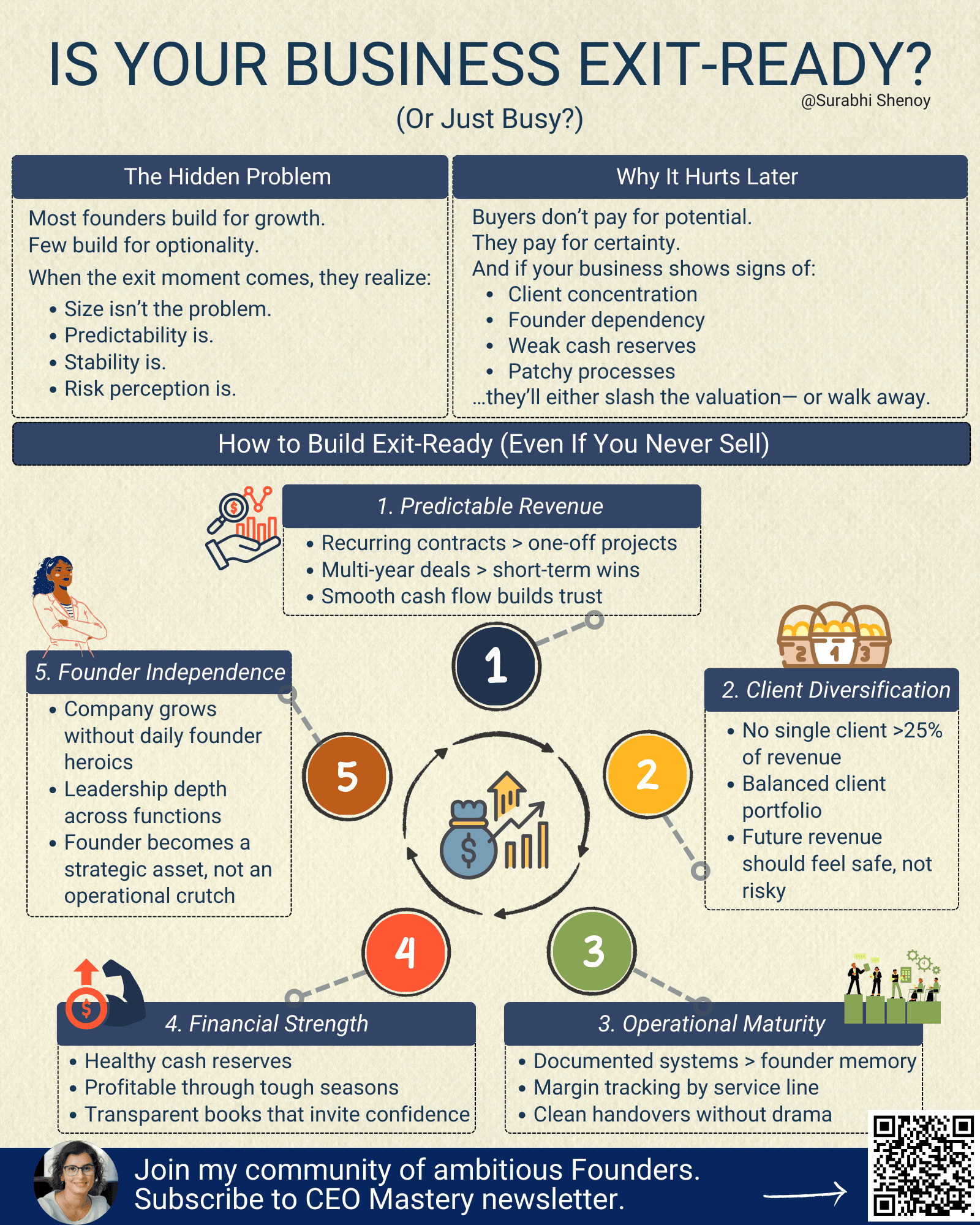

Along with revenue and YoY growth, I focused heavily on:

- Client spread — no one client >25% revenue

- Strong cash reserves — enough to signal stability

- Ops maturity — docs, data, and margin by service line

- Founder independence — systems ran the business, not me

- Predictable revenue — long-term contracts, recurring streams

These were some of the levers that not only derisked our growth, but also ensured we built compounding value.

This preparation paid off. The business had already proven resilience through loss, COVID, and client churn, and it stayed profitable with good cash reserves.

That’s why I had five serious offers on the table. I sold the company on my terms.

Lessons From Exit #2

The most important lesson is if you’re building a business, you should build it as an asset from the beginning. Life is unpredictable, and it feels great to have options.

Start with these 3 simple levers:

1. Valuation = Risk + Predictability

Buyers don’t just pay for size. They pay for certainty.

Anything that reduces risk—like cash reserves or diversified clients—increases value.

2. Revenue Quality > Revenue Quantity

$5M in sticky, recurring revenue is more valuable than $10M in one-off projects.

Buyers don’t pay for peaks—they pay for predictability.

3. Freedom Is Built Into the Business

Freedom from operations isn’t enough. The business itself must show strength—on the management team and in the process.

The business cannot show any signs of collapsing after you leave.

Challenge for You

If someone made you an offer tomorrow… would your business pass their test, or fall apart under scrutiny?

When they dig into your books and operations:

- Will they see an asset—or just activity?

- Will it return their investment in multiples?

- Over what timeline?

- With how much risk?

If the answers aren’t clear (or in your favor) —what’s one step you could take this quarter to change that?

One lever. One shift. That’s where it begins.

📚 My Bookshelf:

Actionable insights from books that transformed me and how I built.

Book: Zero to One by Peter Thiel

Most founders chase competition.

This book taught me to escape it.

In my founder’s guide, I share:

- How I built a monopoly mindset

- What I stopped doing after reading this

- How to rethink differentiation in service businesses

Thanks for being here. See you next Thursday,

Surabhi