Every time we buy a stock — NVIDIA, Apple, Tesla — we do something interesting.

We track the stock price.

We notice it’s every move.

We barely own 0.00001% of the company.

We have almost zero control over this price.

And yet, we watch it closely.

We care. After all, we have invested our hard-earned money in it.

Now look at the contrast.

Most of us own 100% of our own businesses.

We invest years.

Money.

Time.

Blood and sweat.

And yet, many founders do not know what their business is worth today.

Let alone what they are doing to increase it.

As we step into 2026, I want to offer you a clean, practical reset.

A worthy goal.

And to define what “worthy” really means, I’m going to borrow the lens that world’s best investors use to judge a business.

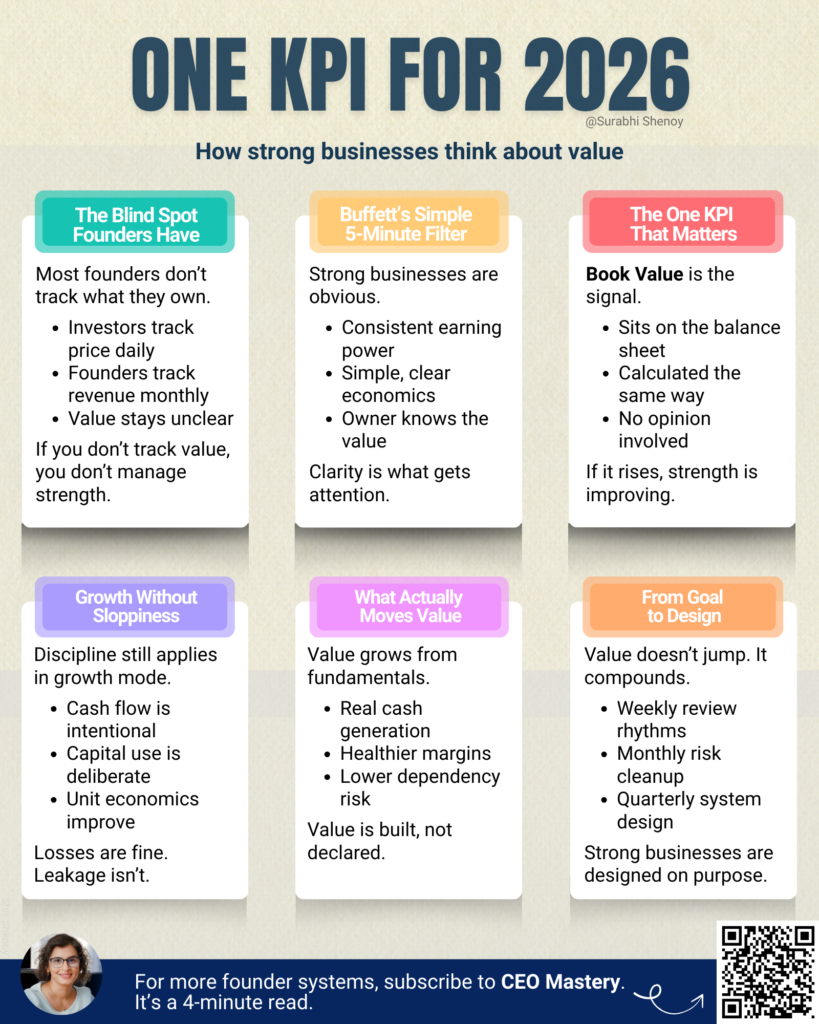

How Warren Buffett Assesses a Business in Five Minutes

For the past few months, I’ve been hanging out with two very wise “grandfathers” of business thinking — Warren Buffett and Charlie Munger.

What stands out is how grounded their business analysis and filtering process is.

In his 1988 shareholder letter, Warren Buffett laid out what he looks for when buying a business.

This is what he said he wants (paraphrasing for founders like us):

- Demonstrated consistent earning power (They are only interested in past performance, not future projections).

- Strong returns on equity, achieved without heavy debt.

- Management already in place — the business shouldn’t depend on them (new buyer) to run.

- A business that is simple enough to understand clearly (How you ‘really’ make money).

- And finally, an owner who knows the business’s value and has an asking price.

He adds, “We can usually tell within 5 minutes if we are interested.”

I was surprised by the 5th point at first. But on reflection, it made complete sense. If the owner doesn’t know what their business is worth, it usually means they don’t fully know their business either.

Strong businesses are clear.

Their numbers make sense.

Their economics are obvious.

Their owners know what they own and it’s worth.

This is how we need to think about value.

Not emotionally.

Not optimistically.

But calmly and concretely.

The One Number as Your Worthy Goal

We don’t manage listed companies. We don’t have a stock price or a ticker.

But we do have one number that is calculated the same way, every time, by standard accounting rules.

It sits on your balance sheet.

Book Value.

No opinions.

No optimism.

No explanation.

Just math.

If this number is rising steadily, your business is getting financially stronger. And a financially strong business can invest in growth, systems, and people to become even stronger, bigger, and better.

Your book value is not the final word on valuation.

But it is a clear signal towards it.

And it’s black and white.

A note for growth-first founders:

If you’re intentionally reinvesting — prioritizing market share, hiring aggressively, or spending on growth — this still applies to you.

Even Amazon wasn’t careless with capital.

- It was cash-flow disciplined, even when unprofitable

- Losses were intentional investments, not operational leakage

- Unit economics improved over time

- Capital allocation was deliberate

- Returns on incremental capital were clear

In Buffett/Munger terms: Amazon sacrificed reported profits, not economic discipline

So, for founders in heavy growth mode, book value won’t always rise in a straight line.

And that’s okay.

What matters is whether the inputs that feed the book value are improving.

Pause Here. Do This Once

Sit with your CFO, accountant, or financial advisor.

Ask two simple questions:

- What is our book value today?

- What specifically would increase it by the end of 2026?

Resist the urge to move 10 things at once. Focus on the few that truly matter. 80/20 applies here, too.

Note: If your Financial Year is Apr-Mar (or anything other than Jan-Dec), consider this as an early start for the next year.

What Actually Moves Book Value

Book value improves when the fundamentals improve:

- real cash generation

- healthier margins

- disciplined use of capital

- lower dependency on any one person, customer, or decision

I’ve written in depth about these drivers before — from my own experience building and exiting companies.

If you want the detailed breakdown, you can read:

The point is simple:

Value doesn’t rise accidentally.

It is designed. You have to be intentional about it.

From Goals to Systems

A goal of increasing book value alone won’t get you there.

The gap is not intent.

It’s execution.

As James Clear says:

“You don’t rise to the level of your goals.

You fall to the level of your systems.”

So set the goal and then focus on rhythm:

- What do you plan and review weekly?

- What do you clean up monthly that reduces risk?

- What do you systemize quarterly to help the business grow with ease?

Book value doesn’t jump.

It compounds.

And compounding needs consistency.

Did this letter make you pause and rethink how you measure progress?

Share it with me and others here.

As we enter 2026, I would encourage you to set the intention:

To build a business that is measurably stronger than it was in 2025.

Revenue will fluctuate.

Markets will wobble.

But well-built businesses endure.

Next time, when you watch the ticker of your favorite stock, don’t forget to think of the share price of your own company. 🙂

Happy and stronger 2026!,

Surabhi

PS: Want to brainstorm and plan for increasing your valuation? Book a call with me here.